Business insights

Built and continously updated with our clients, for our clients

Logic embedded

Reclaim logic and reclaim forms are embedded in the application and permanently monitored

Customizable

Easily customizable to your specific needs and circumstances

Industry approved

Successfully used by many leading banks and service providers

User-friendly web-application

reclaimer® is a user-friendly web-application. It manages and optimises the entire process for withholding tax relief at source and reclaim: from data import and validation, to data enrichment, reclaim/relief calculation, document production, and cash allocation.

Cutting-edge technology, applied

The reclaimer® is a web application based on a Java/Kotlin backend and an Angular frontend. The frontend uses latest technologies provided by Angular like Typescript, RxJS (reactive programming), and Angular Material. The backend provides a REST API implemented with Dropwizard and an API library generated with Swagger. Furthermore, we are using Hibernate for the persistence layer, liquibase for database migrations, CircleCI for continuous integration, and much more.

Learn how reclaimer helps you to enhance the after-tax return of your portfolios

Main benefits

Your advantages of using reclaimer®

Increased after-tax return

Withholding taxes on dividends and interest income reduces return on investment; reclaiming them, where possible, increases return significantly. Depending on yields and treaty rates, you could see an increased return on your portfolio of up to 60bpts per annum.

Reduced Workload

Reclaiming withholding taxes is a bureacratic and time-consuming process. reclaimer® automates the whole process to the extent possible. The entire reclaim logic is embedded and automatically generates all the required paperwork. This saves you valuable time and money.

Reduced operational risk

It is easy to pick the wrong form, the wrong rate, forget about a due date or fill out the form incorrectly. Not anymore! reclaimer® knows the rules and applies them automatically.

Always keep the overview

We know from experience how difficult it is to keep up-to-date with all your reclaims. What is the status of a reclaim? What needs to be done next? When did I send the reclaim to the local tax authority? Which reclaims are ready to be submitted? This is no longer an issue with reclaimer®’s dashboards and other reporting functionalities.

Core Features

Check out some of the main features

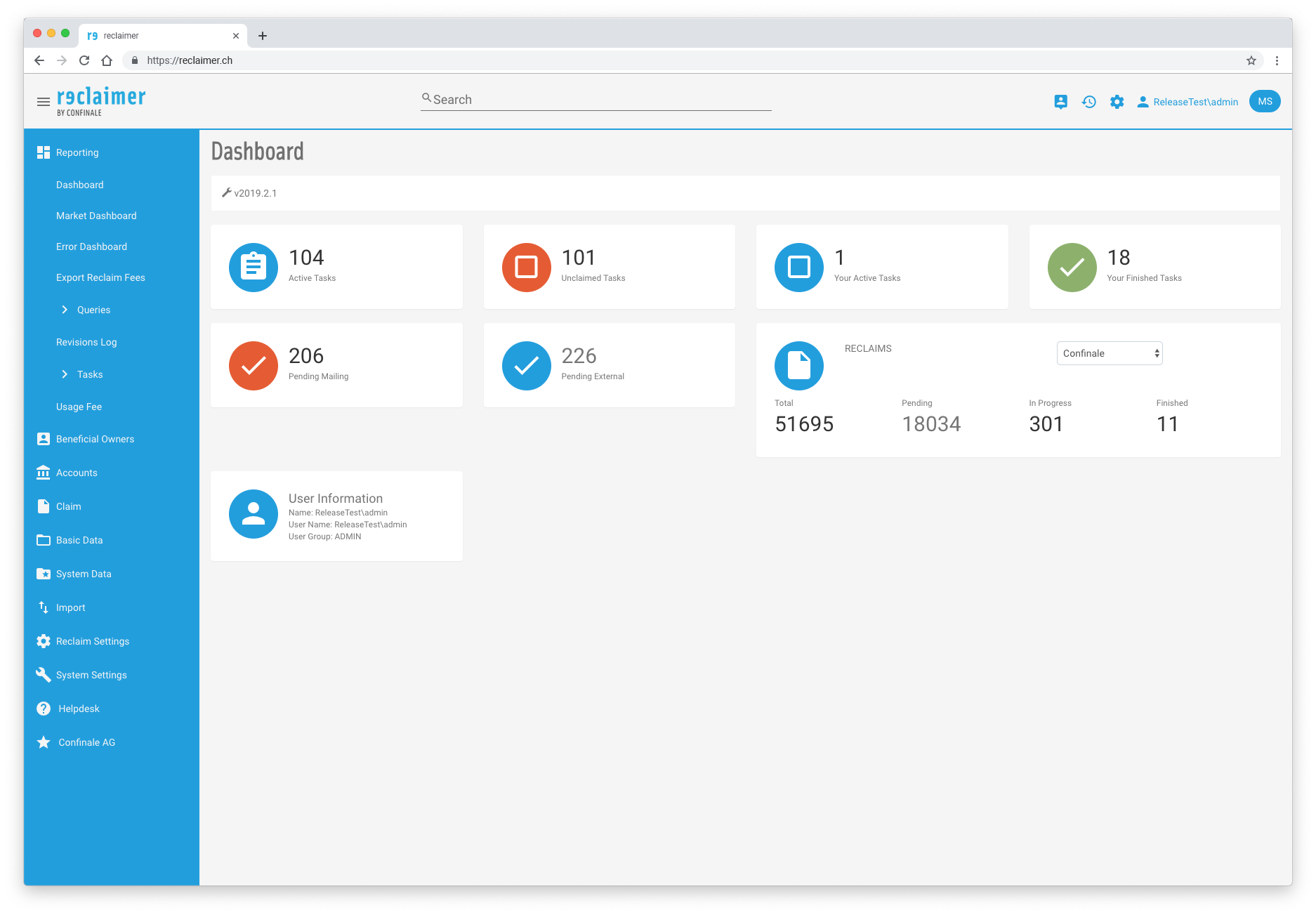

Reclaim cockpit

Our main dashboard gives you an immediate overview: what your next tasks are, what you have pending, and what you have already done.

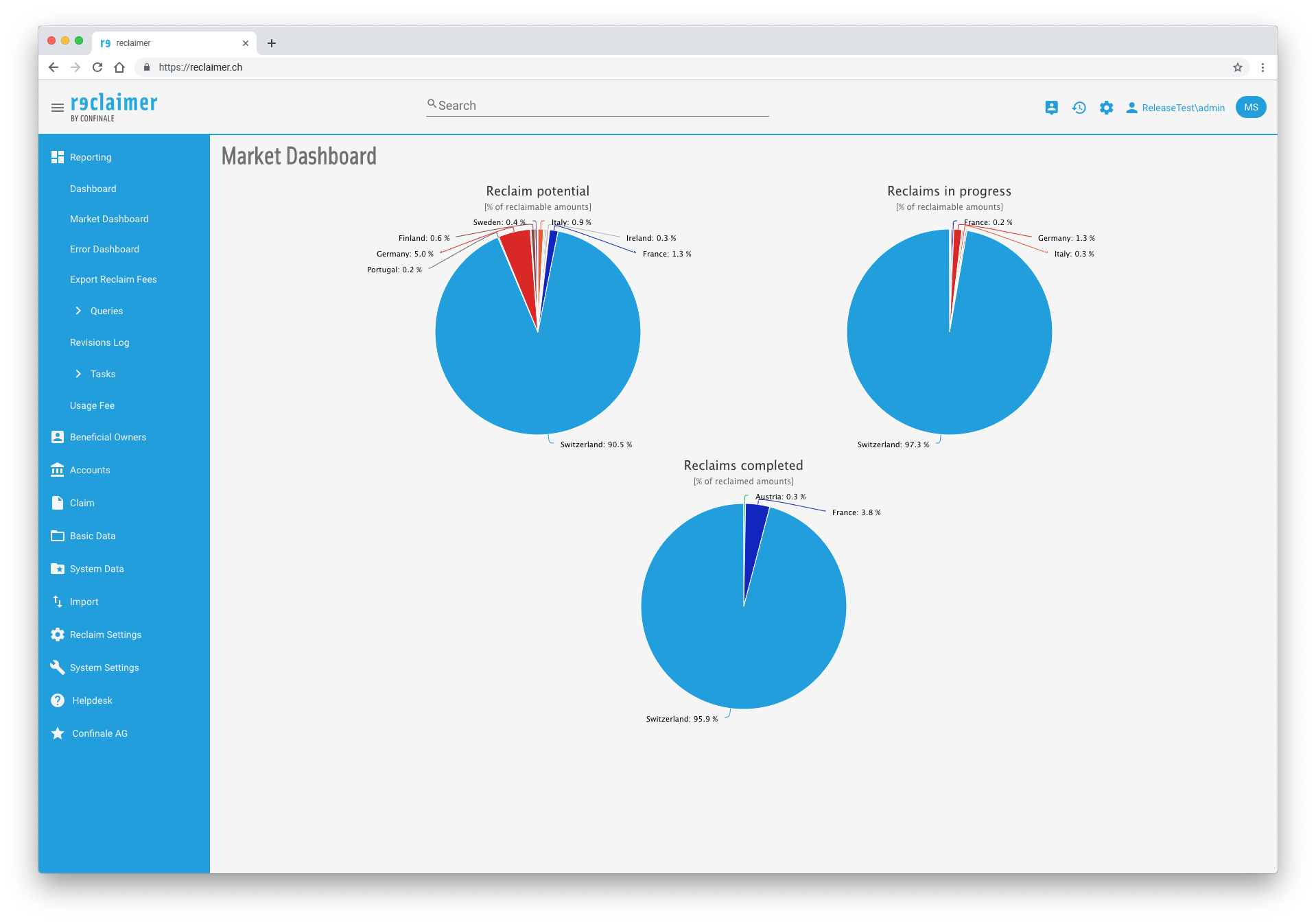

Market Dashboard

For each reclaim market you can easily see what the reclaim potential is, how many reclaims are pending, and how much has been reclaimed already.

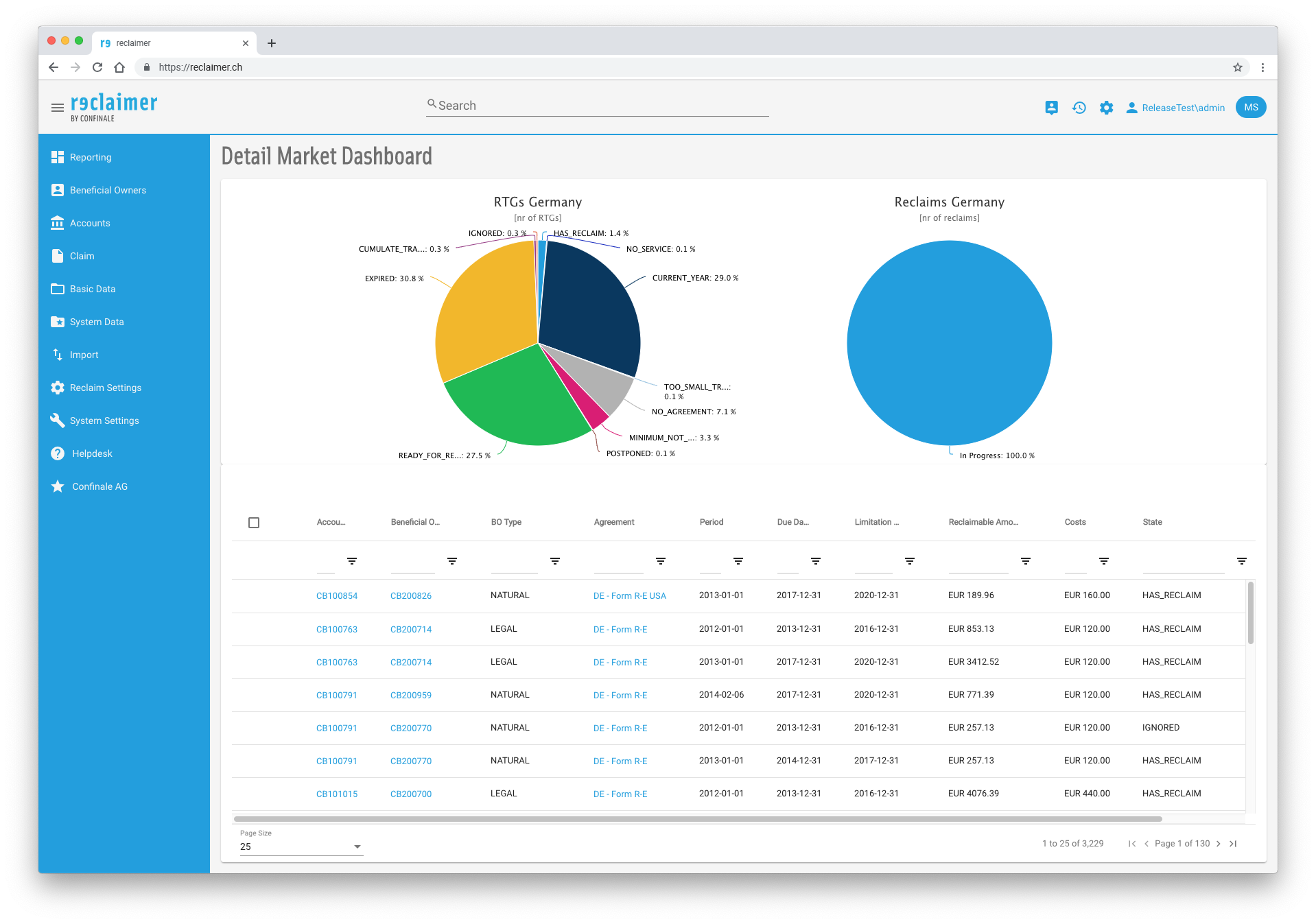

Market Analysis

With one click you get additional information for each market in an easy to read and interpret way.

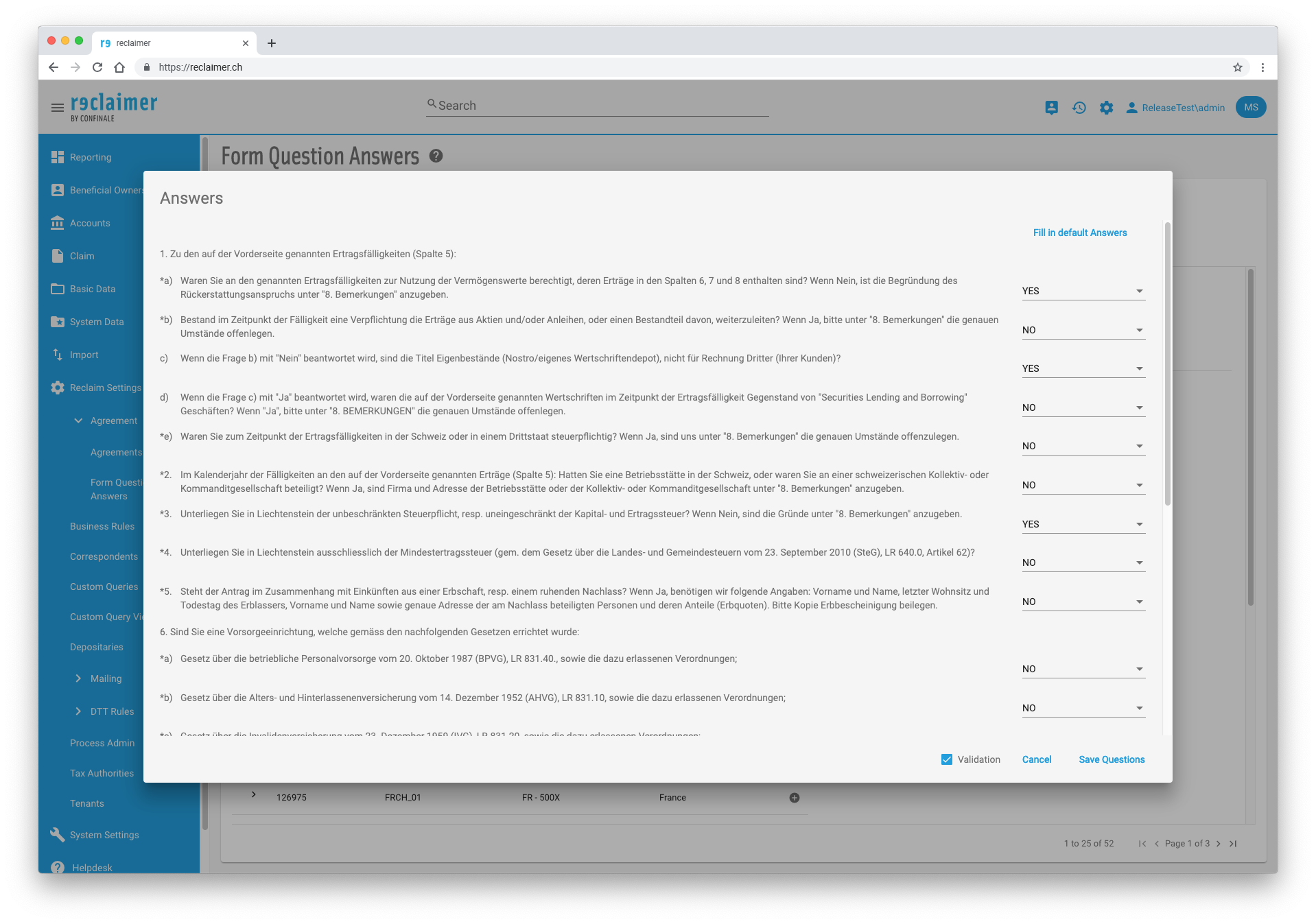

Form Questions

The answers to additional form questions can be added through our user-friendly interface.

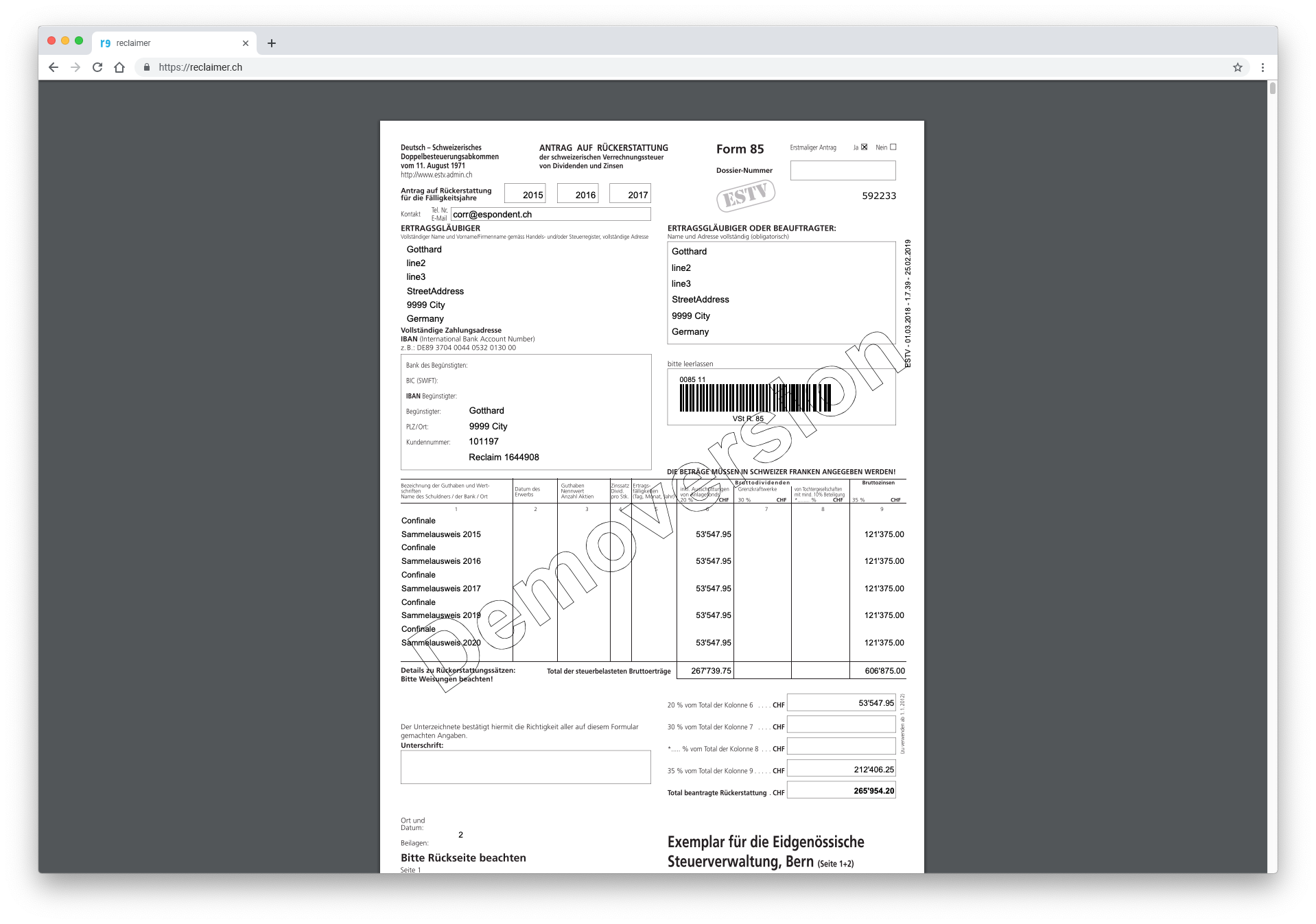

Over 60 reclaim forms embedded

reclaimer® picks the right form and fills it out in accordance with industry-standards.

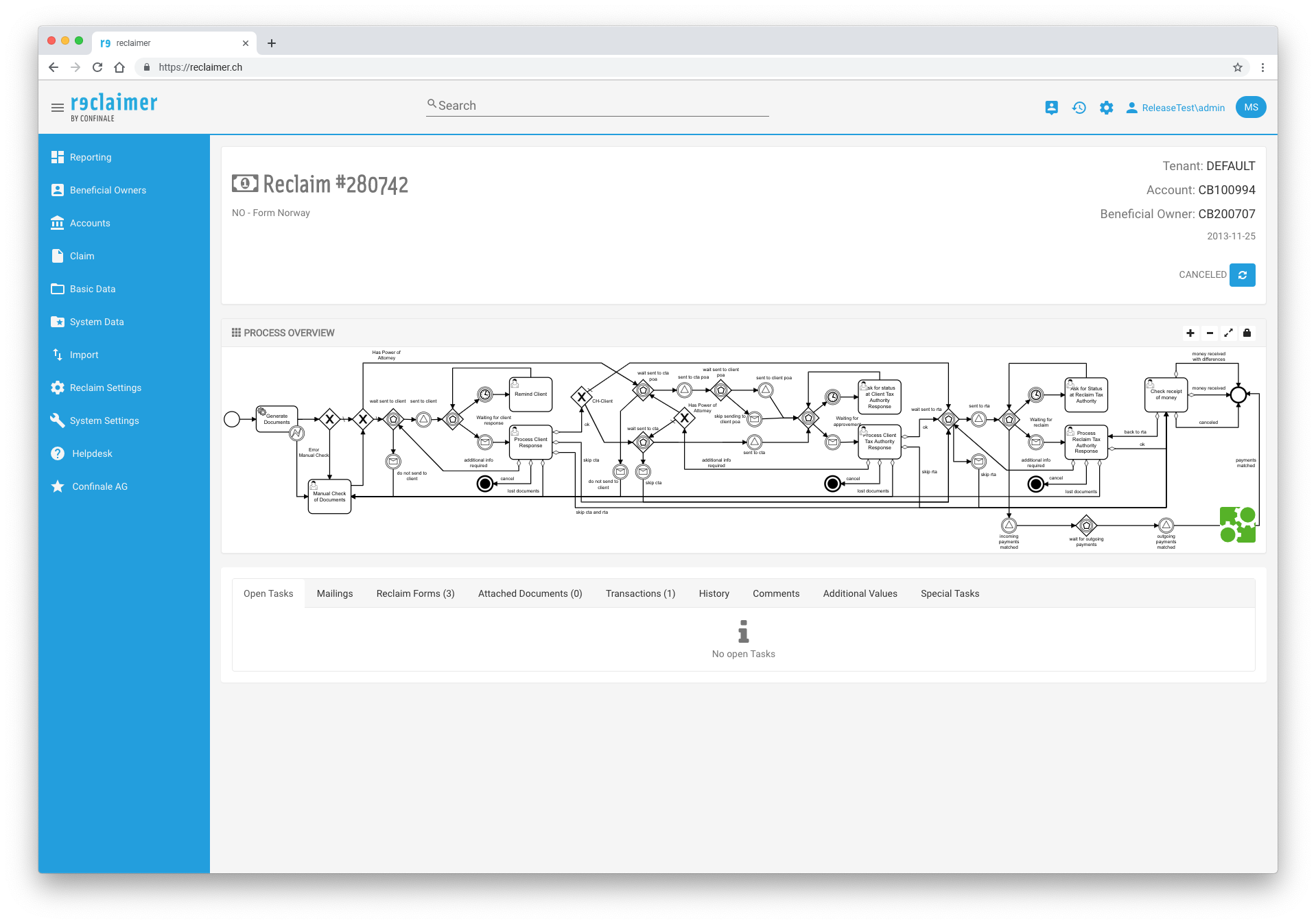

Process visualized

The applicable reclaim process depends on specific circumstances (client domicile, client type, market, power-of-attorney, custodian etc.). Our visualizer tool outlines the details of each process and shows where a reclaim is in this process.

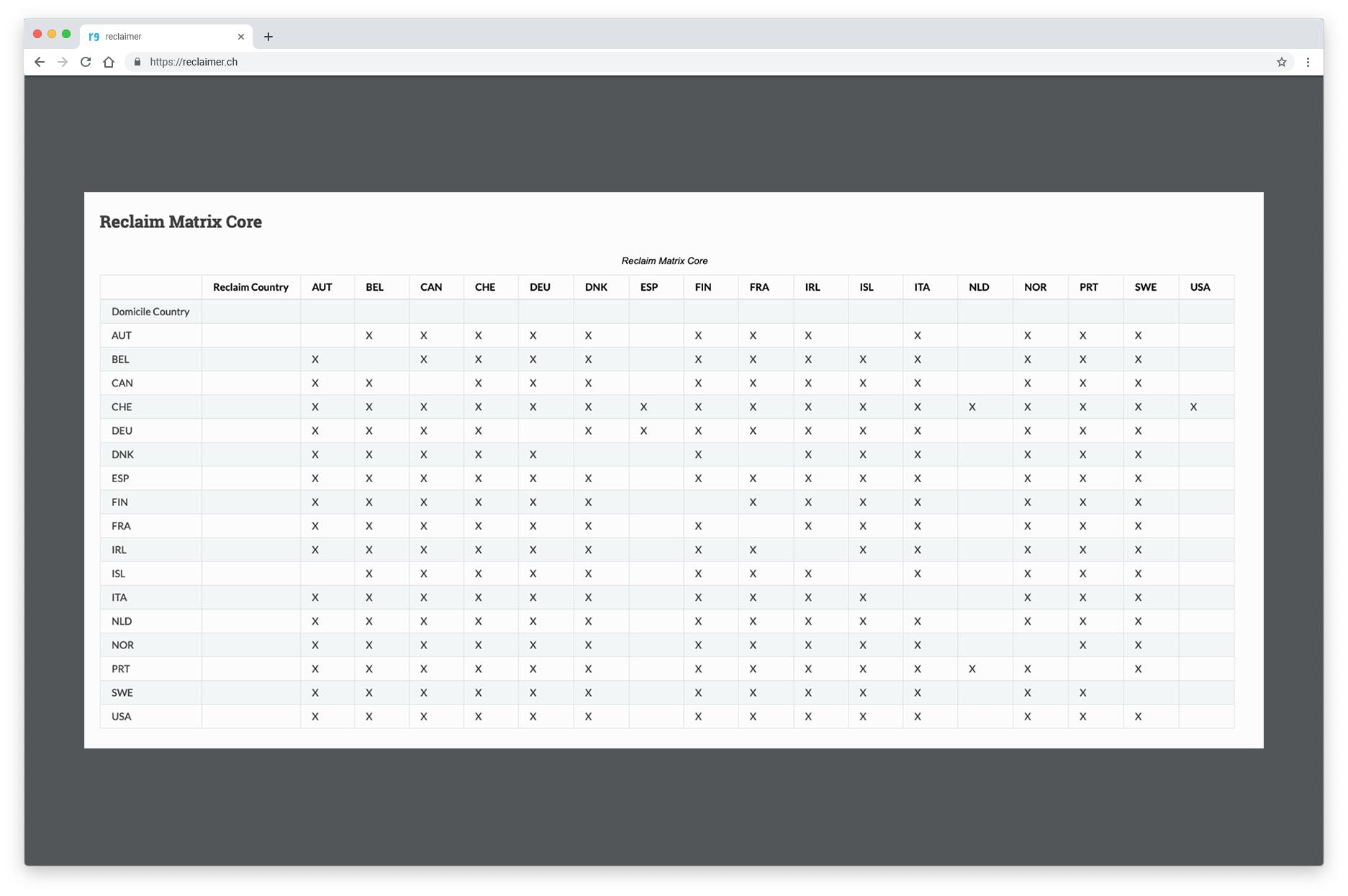

Broad market coverage

reclaimer® covers 17 markets and over 600 market-domicile combinations. Frequent updates make sure the business rules are up-to-date.

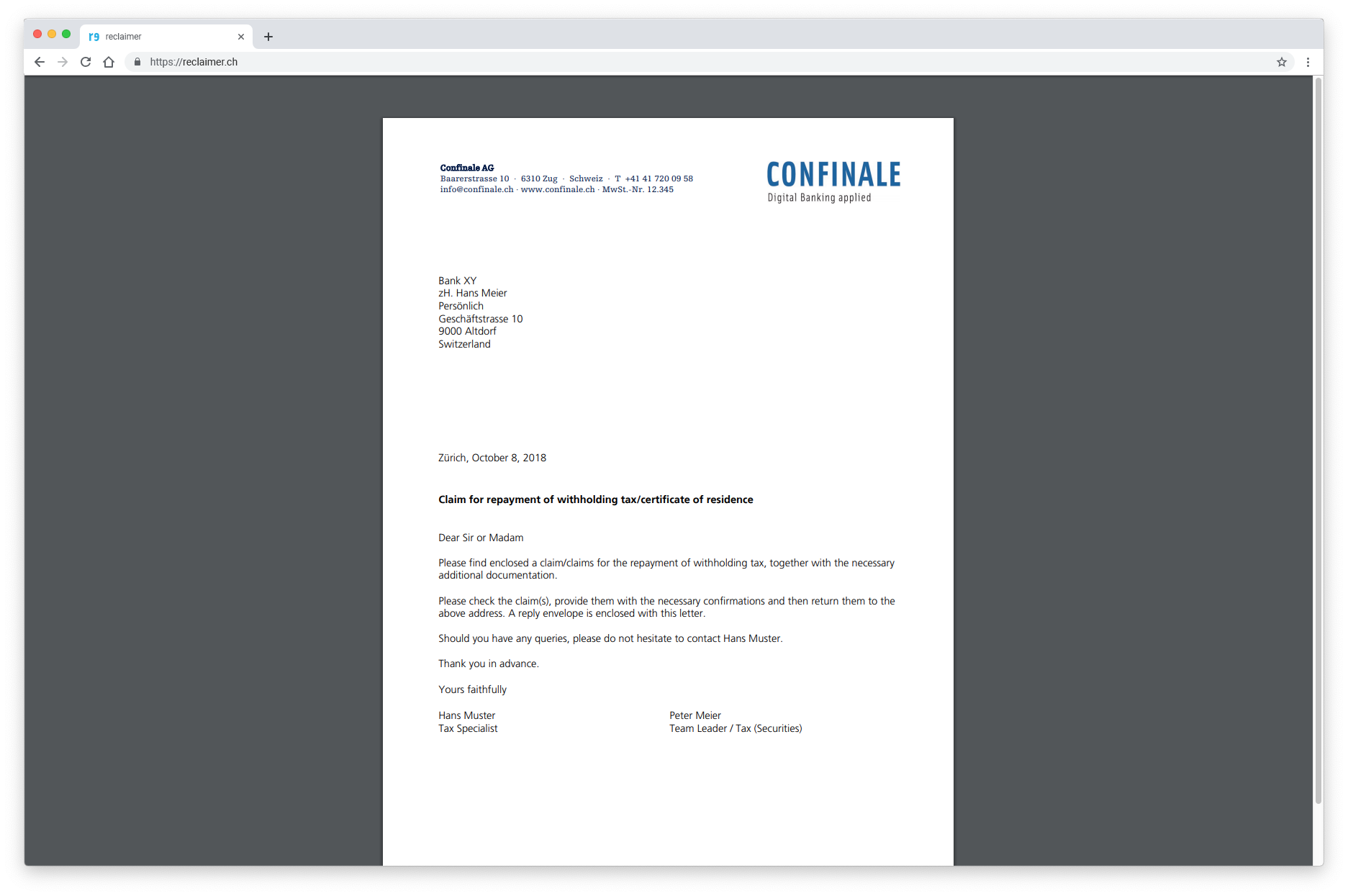

Cover letters

reclaimer® automatically produces the relevant Cover letters using the bank’s CI that are need where forms have to be submitted by post.

Services

Implementation

Implementing and integrating reclaimer® with your existing infrastructure is straight-forward!

Based on a detailed analysis of your existing reclaim potential, systems, operations, and processes: we will, with your input, define your specific needs and requirements and put together an implementation plan that meets your expectations in terms of scope and timing.

Our team of experienced specialists will provide hands-on support during the implementation, configuration, and testing phases.

We are 100% committed to do whatever it takes to ensure that the implementation will be a success, and that you and your team will be able to use reclaimer® as quickly as possible.

Becoming your trusted partner is our number one goal!

On-going support

We are passionate about going the extra mile and addressing any issues or question you may have during your production phase.

Once implemented our technical team will provide on-going support via helpdesk and with the support of an issue-tool. Where needed, on-site support is also available.

New releases are provided on a regular basis, integrating client input; this means reclaimer® is constantly evolving and improving to meet your needs.

And more ...

Our hands-on implementation and on-going support is key, but it doesn’t end there!

We put the success of reclaimer® down to the fact that the software was built in close cooperation with our clients. We are keen to listen to take on board the new ideas and specific requirements of our clients where possible.

With our experienced team of analysts and developers, we will make sure reclaimer® remains the leading tax-reclaim software. To meet this target we follow an ambitious roadmap.

Ready for MiKaDiv

With the new notification procedure Capital Gains Tax on Dividends and Depositary Receipts, German financial institutions and all banks worldwide that trade or hold German shares must expect significant additional work.

In order to obtain German tax certificates or specific UUIDs, a comprehensive set of data must be transmitted to the German Federal Central Tax Office (BZSt) across the various custodians.

Our software solution TaxTrail fulfills all requirements of the German reporting procedure for tax certificates (MiKaDiv) between custodians or directly to the German Federal Tax Authority (BZSt).

TaxTrail is fully integrated into reclaimer. No separate installation is required to use the full functionality of TaxTrail as a unified solution in reclaimer.

Learn more about TaxTrail

References

What our clients say about reclaimer®

Blog

The world of reclaimer never stands still!

Zürich, Jan 2024

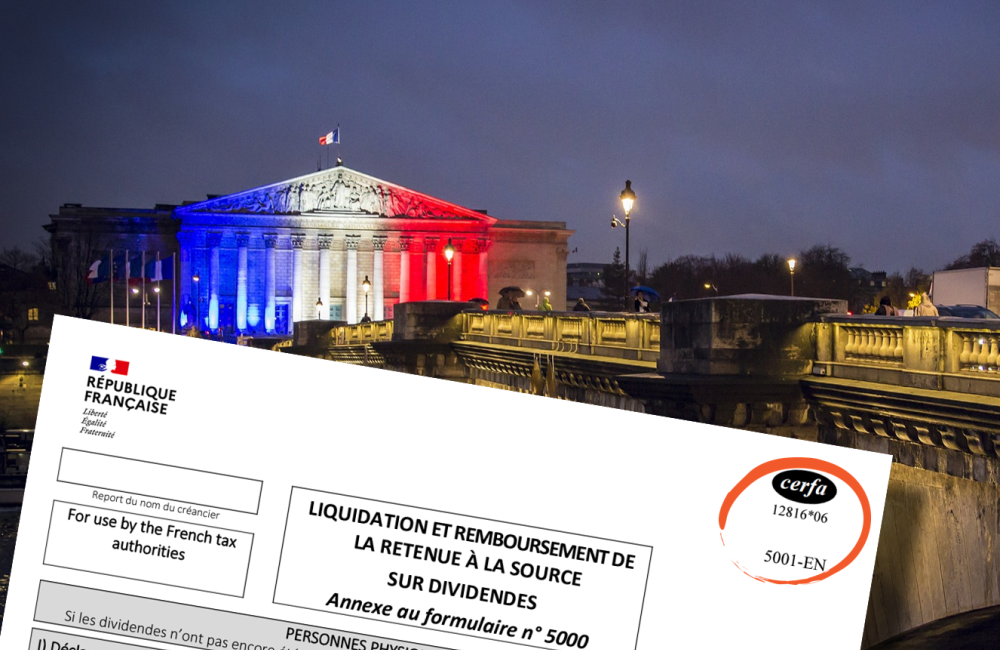

France - New Form 5001 (*06)

The French tax authorities have once again issued a new form 5001 (cerfa*06), which must be used for dividend income from 2024 onwards.In addition t ...

Zürich, Nov 2023

E. Gutzwiller & Cie, Banquiers - Efficient withholding tax reclaim

The process of withholding tax reclaims tax is highly bureaucratic, technically demanding and time-consuming. Especially if a bank has to handle the r ...

reclaimer® is a product of HCLTech Confinale Wealth Solutions

HCLTech Confinale Wealth Solutions, a business unit of HCLTech, is an IT consulting and software development company that specialises in digitalisation projects for the banking sector. Thereby we focus on the fields of taxes, compliance and wealth management. We find solutions for current and future challenges either by implementing new functionalities in existing core banking software, or by developing new applications like reclaimer®.

www.confinale.ch

Interested?

For more details on reclaimer® and how it can support your business please don't hesitate to get in touch.

Contact us